Core Banking Solution

Mbanq brings you the easiest and most economical path to deploy digital financial services that scale to your exact needs.

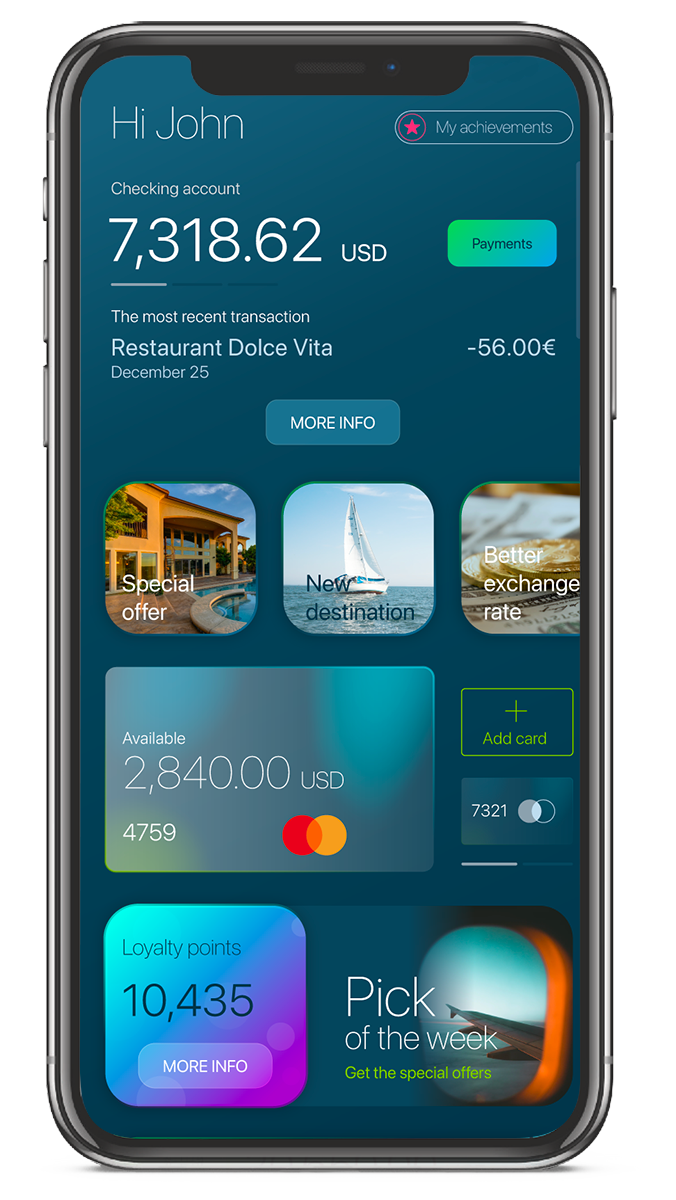

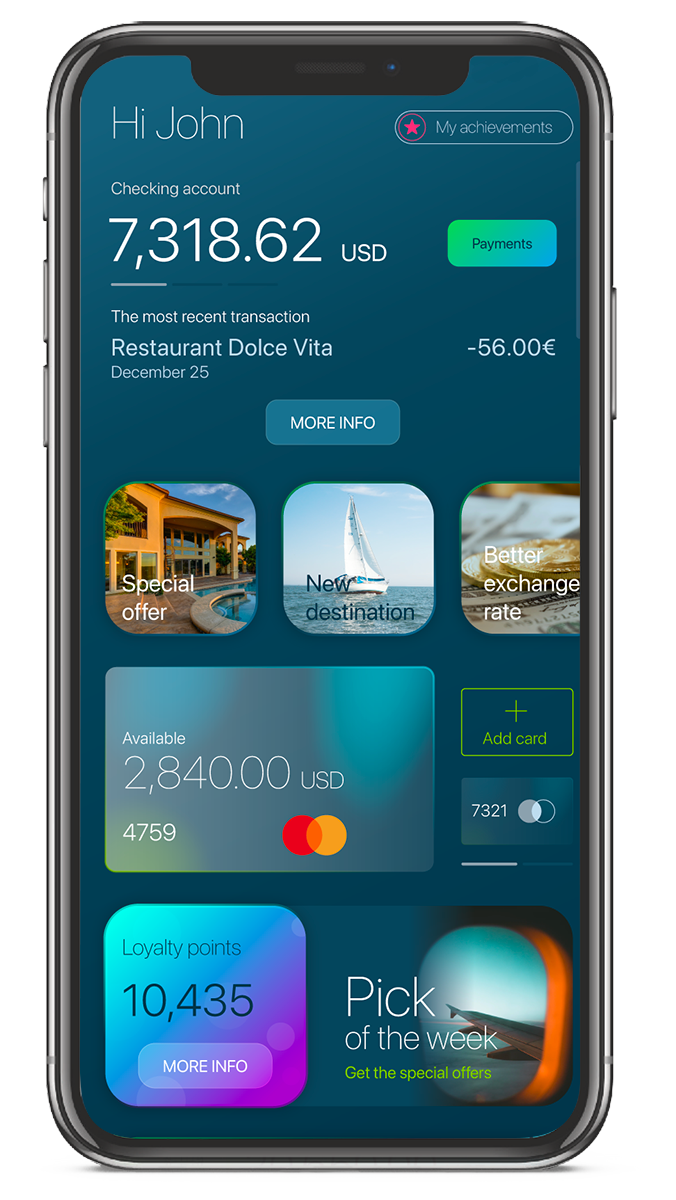

Cloud-based back-end technology connects to global financial infrastructure, beautifully responsive white label mobile apps for your customers, a US bank license sponsor, fully managed. A comprehensive portfolio of technology and services to create a digital bank, FinTech or Embedded Banking to serve your clients. Ready to deploy in weeks.

Mbanq’s unique value proposition is its ‘as-a-service’ portfolio to simplify life in a highly-regulated industry. Anti-fraud, KYC, address verifications, customer identification (CIP), AML, sanctions lists, biometrics and document scans, compliance and regulatory reporting and dispute resolutions – everything is taken care of so that you operate with safety and full regulatory approval.

Detailed Overview

Mbanq spearheads modern digital transformation in the financial services industry. It enables third-party companies, including non-banking brands, to offer a wide array of financial products to customers by leveraging the banking license of a partner bank. This removes the need for third-party businesses to acquire their own banking licenses, significantly simplifying their entry into the financial services arena.

In addition to enabling traditional banking services, Mbanq provides a range of ‘as a service’ offerings, such as Compliance-as-a-Service (CaaS), Regulatory-as-a-Service (RaaS), and Payment-as-a-Service (PaaS). This comprehensive support allows businesses to offer complete, seamless, and compliant financial solutions to their customers.

Mbanq brings an easier, faster, simpler and cost-efficient solution for any banking or banking-type institution. It takes care of the main technology and operations aspects.

With Mbanq’s proven expertise it is the fastest and most efficient approach to digital finance.

Mbanq brings an easier, faster, simpler and less costly solution for any banking or banking-type institution. It takes care of the main technology and operations aspects.

Mbanq’s proven expertise provides the fastest and most efficient approach to digital finance.

Compliance-as-a-Service

and Regulatory-as-a-Service

These offerings allow businesses to stay up-to-date and compliant with the ever-changing financial regulatory landscape. Mbanq’s compliance team brings its own signature to the table to help your business with regulatory compliance, including the latest government and regulatory-body inputs.

This is a vital component to successfully operate in a competitive financial market.

Mbanq also integrates with digital onboarding and Know Your Customer (KYC) tools to facilitate seamless customer acquisition and adherence to regulatory requirements.

Banking Intelligence

Mbanq thoroughly examines your business case, business modeling and strategic plans, and offers comprehensive feedback and advice on best practice based on its senior team’s multi-decade banking and finance experience. This provides a solid basis for success while assisting you in overcoming unforeseen challenges.

Mbanq’s solution offers a competitive edge with faster market entry, cost efficiencies, and the ability to prioritize core competencies while expanding services more gradually.

Mbanq prides itself on cultivating more than just client relationships; it fosters business partnerships and friendships to ensure your project succeeds.

At Mbanq, we are at the center of a vibrant FinTech ecosystem, equipped with the necessary technology, services, and outreach to establish a digital banking platform and enhance network value through our Banking Intelligence expertise

to success

consisting of 3 easy steps to guide you

Process:

Discovery

NDA and Services Definition

Mbanq KYC and Compliance Check

a thorough compliance check. This step helps establish a strong foundation for a secure and trustworthy partnership. It is executed promptly and it is completed within a 24 hour timeframe.

Onboarding Journey

Technical Call and API Information Sync

Service Level Agreement (SLA) between Client and Mbanq

Client Onboarding and Documentation Collection

Go Live

Submission and Approval with Sponsor Banking Partner

Client's BaaS Platform Launch and "Go" Live!

NDA and Services Definition

Mbanq KYC and Compliance Check

a thorough compliance check. This step helps establish a strong foundation for a secure and trustworthy partnership. It is executed promptly and it is completed within a 24 hour timeframe.

Technical Call and API Information Sync

Service Level Agreement (SLA) between Client and Mbanq

Client Onboarding and Documentation Collection

Submission and Approval with Sponsor Banking Partner

Client's BaaS Platform Launch and "Go" Live!

Our team takes you by the hand to guide you through all necessary steps. We’ll be with you every step of the way, ensuring a successful and rewarding partnership.

We look forward to working with you!

CORE BANKING UNDERPINNED BY SERVICES

Your customers benefit from financial products delivered through a stylish app as well as beautifully designed debit and credit cards with your brand insignia.

You benefit from increased revenue and by outsourcing the whole process – from technology to compliance to program management and customer support.

DIGITAL-FIRST BANKING IN A MODERN WORLD

Agile implementation for quick results

Contracting

- Initiation

- Definition of contracted services

- Mbanq KYC and compliance check

- Service level agreement between client and Mbanq

Compliance and Regulatory

- BSA Policies and Procedures

- Due diligence and risk review

- License sponsorship approval

- BSA & AML policies

- Regulatory setup, SAR & OFAC checks

Deployment

- System delivery

- Establishment & activation of contracted services

- Launch support

Operations Support

- Maintenance and support according to SLAs

- Initiation

- Definition of contracted services

- Mbanq KYC and compliance check

- Service level agreement between client and Mbanq

- BSA Policies and Procedures

- Due diligence and risk review

- License sponsorship approval

- BSA & AML policies

- Regulatory setup, SAR & OFAC checks

- System delivery

- Establishment & activation of contracted services

- Launch support

- Maintenance and support according to SLAs

Complete technology stack

User Types

- Consumer

- Business

Products

- Deposit account

- Savings account

- FBO with sub accounts

- Custodial accounts

- Clearing accounts

- One-time loans

- Revolving credits

- Open credits

- Cash advance

- Brokerage accounts

- Other

User Base

- American domestic (min 51%)

- International

Payments

- Card Issuance:

– Debit card linked to deposit account

– Credit card linked to revolving credit - Account/routing issuance

- ACH – same day

- ACH – standard

- Wires – domestic

- Wires – international

- RPPS (Bill Pay)

- Remote deposit capture

- Acquiring – push/pull from cards

- Other

We’ve built the Core Banking super-engine

YOU DRIVE IT wherever you want!

We’ve built

the Banking-as-a-Service super-engine

YOU DRIVE IT

wherever you want!

Enjoy multiple advantages by creating a FinTech-driven banking platform:

Banking Profitability

Every time a fan buys anything through your branded account, debit or credit card you get access to a major source of new revenue – interchange fees. Shoes, flights, dining out: you get a piece of every pie.

Control of Travel and Expenses

The ultimate in travel and production cost management. Each staff member has their own card. Your financial controller sets the budget in real time – from airport sandwich to yacht.

Full Control of Payments and Disbursements

You customize systems and processes for your specific needs for greater flexibility and efficiency in managing transactions.

Branding and Loyalty

Your brand, your face in every wallet in every pocket. Loyalty points bring rewards to fans and direct spending towards what really matters.

Payment Services

Direct debits, money transfers, bill payments, checkout process, foreign exchange. You’re a full service bank, you have everything that you need and everything your fans need.

Cross-selling

Fan apparel, concert tickets, cross-industry deals – integrated and personalized.

Customer Data and Analytics

Running a bank gives direct access to transaction data and financial analytics and provides actionable insights to benefit every customer. The possibilities are infinite.

Personalized Services and Targeted Marketing

Leverage customer data to offer personalized services and targeted marketing. You align services and campaigns with customer needs and provide relevant product recommendations, and personalized financial solutions. This level of personalization is cutting-edge, builds loyalty and drives customer satisfaction.

Banking Profitability

Every time a fan buys anything through your branded account, debit or credit card you get access to a major source of new revenue – interchange fees. Shoes, flights, dining out: you get a piece of every pie.

Regulatory Control and Compliance

With Mbanq’s help you have direct control over compliance with financial regulations and industry standards. Together we establish internal policies and procedures to ensure full adherence to financial industry rules and regulations so you remain protected to the highest possible standards.

Enhanced Security

Mbanq and its partners implement rigorous security measures, both technology and policies & procedures, to monitor and protect customer financial data and every transaction.

Even more Profitability

Loans and financing, mortgages, installment payments, customized financial products, you access the entire potential of the global financial system.